Please answer problem 7-8 (pg 316) from the book "Plant Design and Economics for Chemical Enginee...

Please answer problem 7-8 (pg 316) from the book "Plant Design and Economics for Chemical Engineers" 5th edition by Max Peters, (note that this problem is modified to include constant depreication rate of 20% per year and income tax rate of 35%). Show all steps clear and show all formulas used. Have to understand how you calculate the values. Please do not use previous solutions on SubjectMate, need new CLEAR solution, if cannot solve it please leave it for someone else. thank you.

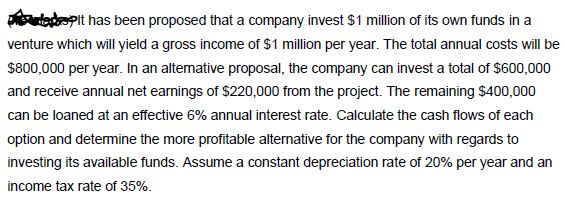

it has been proposed that a company invest S1 million of its own funds in a venture which will yield a gross income of $1 million per year. The total annual costs will be $800,000 per year. In an altenative proposal, the company can invest a total of $600,000 and receive annual net earnings of $220,000 from the project. The remaining $400,000 can be loaned at an effective 6% annual interest rate. Calculate the cash flows of each investing its available funds. Assume a constant depreciation rate of 20% per year and an income tax rate of 35%.

Solved

Chemical Engineering

1 Answer

Wisdom Agleber

Login to view answer.